/ Assumptions.

Application for customer advisors to flexibly configure and sell credit products tailored to customers' special requirements in any distribution channel

The main goal of the Opti application was to enable customer advisors to flexibly tailor credit products to the specific needs of customers applying for a loan in a given sales channel. Moreover, to ensure the highest level of customer experience at every stage of the credit application process and across all available distribution channels.

The target users of this application were primarily customer advisors from the bank’s credit sales teams across various channels, ranging from call centers to bank branches and partner outlets. Delivering a well-crafted tool tailored to advisors’ needs was expected to directly impact the end-customer experience.

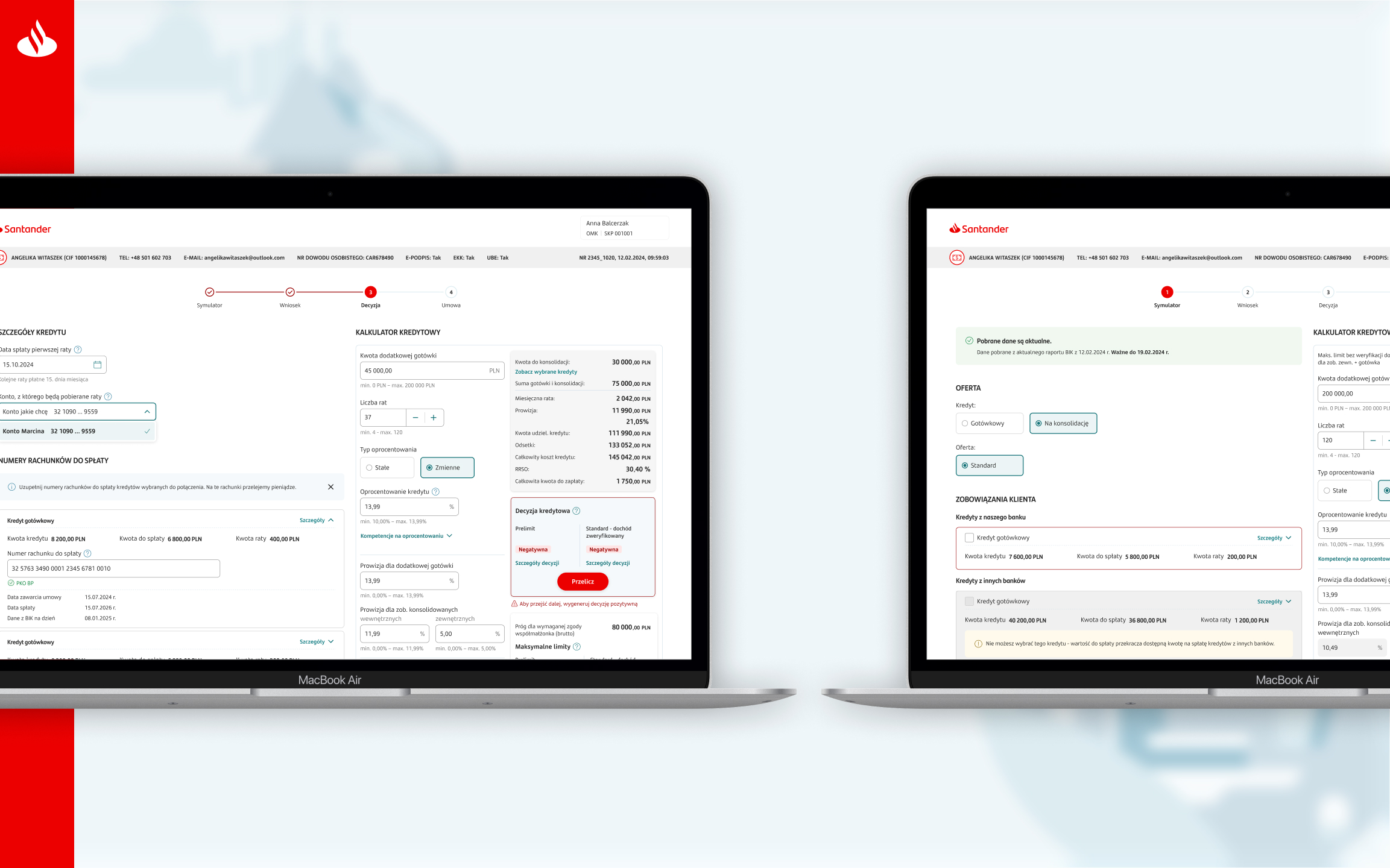

As the name suggests, this solution represents an Optichannel approach, allowing the analysis of customer activity across different credit sales channels and helping to identify the most profitable one in the given context by solving customer problems and addressing their deeper needs.

The idea behind this approach enables smooth transitioning of a credit application between channels and tailoring the bank’s offer to special customer requirements.

For example, a customer who starts a loan application via online banking can complete it via the call center or at a branch with the assistance of an advisor. Similarly, a customer advisor can initiate a loan application on behalf of a client calling the call center or visiting a branch and then pass the process to online banking, where the client can finalize it and sign the credit agreement.

The use of this solution is not limited to these scenarios—it enables multiple transitions between sales channels throughout the application process.

This solution not only provides comprehensive and seamless experiences for customers during the entire loan process but also boosts credit product sales by addressing previously overlooked paths and cases in customer service.

Additionally, a range of mechanisms implemented in the application allowed for flexible shaping of both credit product conditions and pricing.

/ OPTI APP

The process of designing a product

/ Discovery Stage

I joined the Opti application project while the solution was already in development. I inherited the UX/UI designer responsibilities from a colleague who was leaving the organization.

The first phase I participated in was a kick-off workshop with the business team responsible for the product. During this session, I was presented with all project-related information—ideas, business goals, application assumptions, target user descriptions, along with their needs and pain points. We also briefly reviewed early-stage design canvases outlining product assumptions, as well as findings from both qualitative and quantitative research. I also familiarized myself with current app ideas and the marketing strategy behind the Optichannel approach, which was the foundation for this solution.

To better understand the product’s specifics, I reviewed the existing design canvases and research findings in the form of reports and Miro boards. This allowed me to form a realistic picture of the needs and problems the solution had to address.

In parallel, I participated in the preparation of a competitive analysis aimed at assessing how our competitors handle credit product sales across multiple channels and the extent to which their processes overlap.

The next step was reviewing the latest findings from this competitive benchmarking, focusing on how other financial institutions handle credit application transitions across sales channels. The results helped identify potential functionalities we could implement and better understand where our competition stood in terms of multichannel credit product sales.

/ Develop stage

Since my predecessor was a UX researcher rather than a designer, I conducted an audit of the components used in the application to verify their compliance with the bank’s design standards. I corrected any inconsistencies with the Flame Design System and updated the mockups accordingly. All changes were reviewed and aligned with the product team.

As a significant amount of time had passed since the last usability tests, and several new features had been introduced, we decided to conduct usability testing with our target users to evaluate the system’s usability and gather feedback on the newly developed features.

I started with a planning meeting to define the goals and scope of the usability test. I then wrote a test scenario and recruited advisors selected by their managers. I prepared a clickable prototype featuring the happy path. The interviews lasted about an hour, and I acted as the moderator. After the sessions, I analyzed the recordings and notes, created a report with recommendations, and presented the findings to the product team using a Miro board.

Following the research, I implemented usability improvements into the application mockups. I reviewed the updated designs with the product team and handed them off to developers, providing explanations of how the features should behave and function.

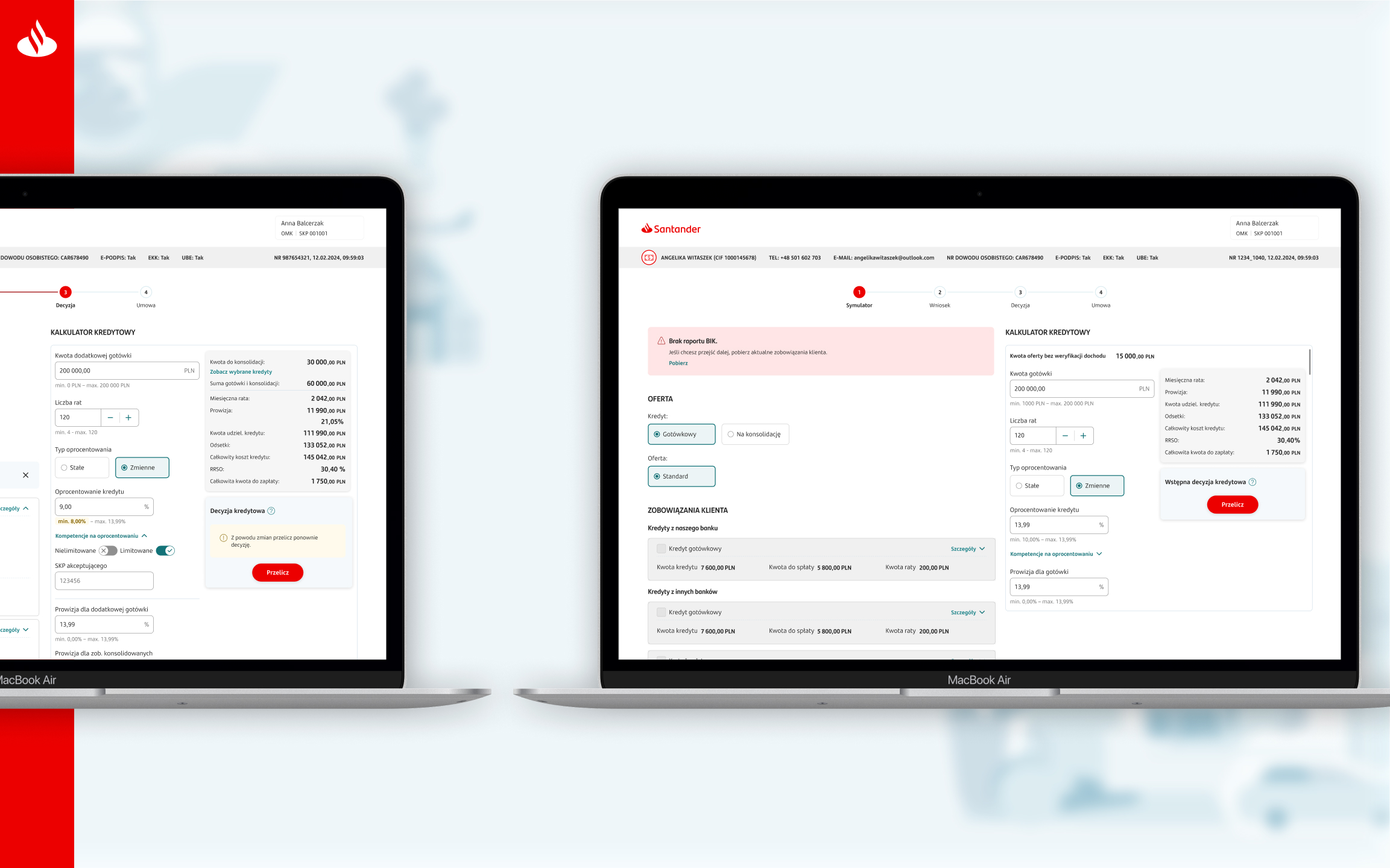

Next, I began designing the credit calculator module, which allowed for flexible configuration of credit product parameters.

The project started with business meetings where we defined assumptions, requirements, and technological constraints together with product owners, customer journey specialists, and business analysts. Directors from the sales departments also actively contributed to defining business needs during workshops. My engagement in these sessions helped streamline the design process.

Although stakeholders were present to define user needs, we also planned a survey to deepen our understanding of unclear areas.

I created the survey by selecting and drafting appropriate question types. Then, I built the questionnaire using Webankieta and distributed it to a selected group of advisors. After the response window closed, I analyzed the data and compiled insights on a Miro board, which I discussed with the product team.

Then, I collaborated with business analysts to prepare user stories describing specific system functions, which supported further design work.

Before creating mockups, I conducted desk research of industry sources and market solutions to identify best practices in designing advanced product and service calculators.

Based on the previously gathered data, I began designing the solution. I started each new functionality with low-fidelity mockups to rapidly generate multiple potential solutions focused on requirements rather than visual polish.

Next, I translated these low-fidelity wireframes into final views using components from the Flame Design System, our design standard. When suitable components were missing, I created new ones using design tokens and consulted them with the Design System team to ensure compliance.

The final calculator mockups were reviewed with the product team, where we assessed and selected the solution that best met the identified requirements.

Similar to earlier stages, some features were developed during live design sessions, which allowed me to make real-time changes. This approach enhanced understanding of business assumptions and accelerated mockup iteration.

At the end of each functionality design phase, I consulted the final mockups with plain language specialists to ensure communication was accessible to all employees using the application.

Once the credit calculator was designed, it was time to validate the solution with users. We planned usability tests to assess understanding of how to configure, calculate, and generate credit decisions.

I started by defining the research objectives and scope, then wrote the test scenario and recruited participants from the selected advisor pool. I prepared an interactive prototype covering multiple usage scenarios. The sessions lasted around an hour, and I moderated them. After the tests, I analyzed recordings and notes, prepared a report with recommendations, and presented it to the product team.

Based on the usability results, I implemented changes to the mockups and reviewed them with the product team before handing them off to developers. I actively collaborated with the dev team, explaining the intended behavior of each feature.

When transferring mockups for development, I conducted a short training session for developers on how to use the Flame Design System documentation.

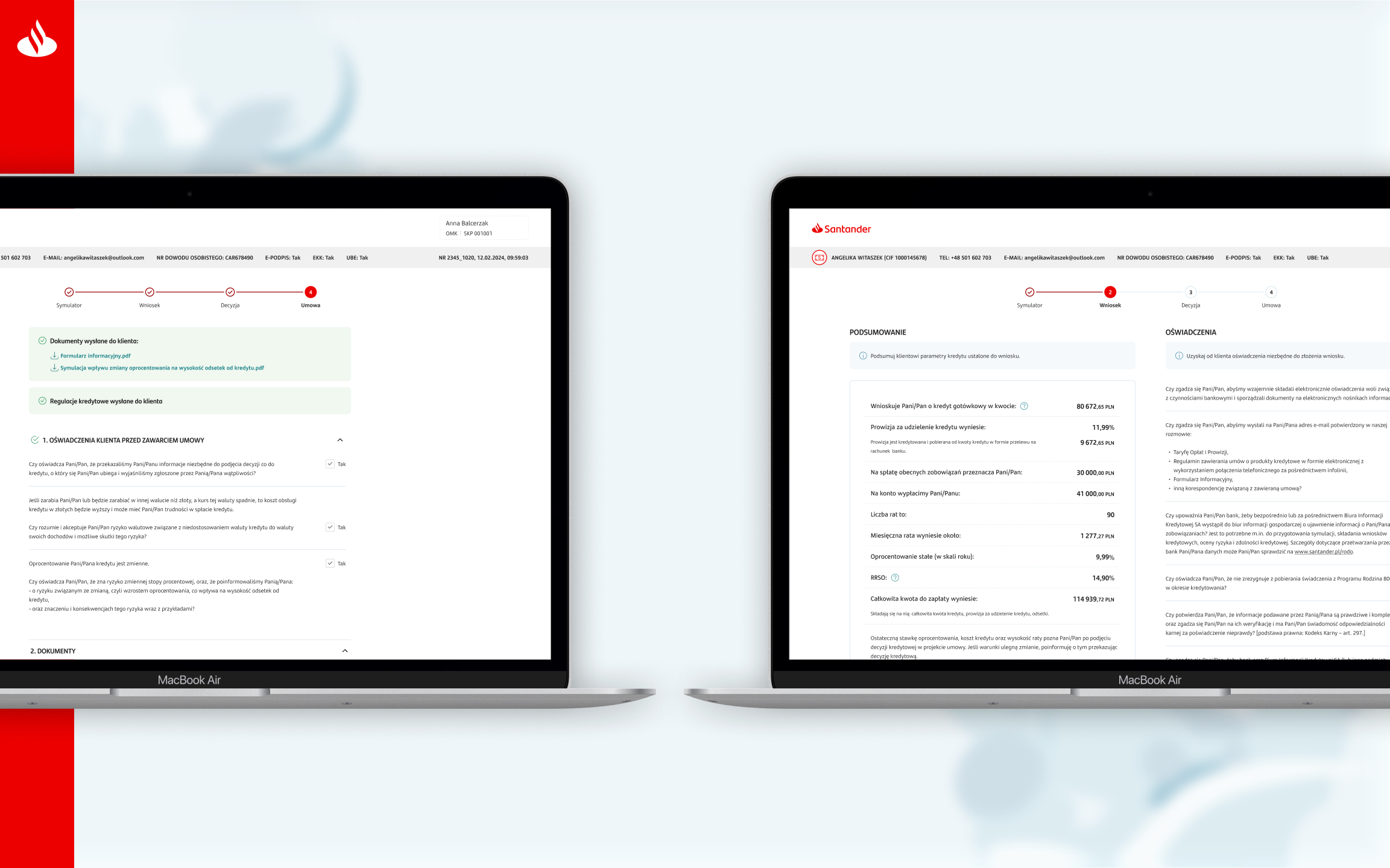

Subsequent functionalities and steps in the credit application process were designed using the same workflow, so I won’t describe each individually. In addition to the calculator, I also designed the second and third steps of the application process, promo code handling, price competency module, and others.

Not everything went as smoothly as with the calculator. Frequent “U-turns” in business requirements or technical limitations discovered by analysts required me to organize kick-off meetings to analyze the changes and apply updates to mockups and user stories. Having developers attend these sessions helped ensure seamless handoff of changes.

/ Deliver stage

After releasing the MVP version of the application to test environments, I worked closely with developers and testers to identify and fix implementation bugs to ensure alignment with the mockups. Occasionally, compromises were necessary due to technical constraints, and certain interactions had to be dropped. However, we aimed to maintain consistency with the Flame Design System standards and documentation.

A key moment in this stage was a real-use simulation experiment. The goal was to test the solution as if it were already live and used independently by advisors.

We designed a usability study with IDI elements, where the moderator played the role of a customer applying for a cash or consolidation loan.

We began by writing a realistic use case to simulate actual user behavior: a customer abandons the application in online banking, then calls the call center and completes the process with an advisor. I wrote the test scenario covering all use cases and recruited advisors from a pool of staff handling those credit types. Then we configured the test environment with help from developers and testers.

We conducted application tests combined with interviews. Afterward, I analyzed recordings and notes, prepared a report with insights and recommendations, and presented the findings to the product team and UX guild.

The experiment yielded valuable conclusions and ideas for improving the application.

To discuss them, we held a workshop where we analyzed each proposal for feasibility given our current constraints. Some changes were implemented into final mockups and handed over to developers.

That was the last design stage I was involved in, as a new team member was hired to replace the colleague who had left. I handed over the project at the MVP implementation phase.

Besides wireframing, prototyping, and research, I also worked on graphic assets, promotional materials, charts, and presentations to support internal promotion of the solution.

/ Summary

Participating in this project taught me how to work in a dynamically changing business environment, where goals and assumptions frequently evolved.

Collaborating with the business team was crucial, as it required a deep understanding of business needs and technical limitations. This pushed me to build a common language with stakeholders.

Frequent requirement changes taught me not to get attached to my designs and to remain open to generating new ideas.

Using proper collaboration techniques—kick-off meetings to define assumptions and live design sessions to develop functionalities—enabled us to efficiently generate solutions.

The rapid pace of changes taught me to generate and validate ideas quickly through usability testing.

The project also deepened my understanding of working with developers and emphasized the importance of thoroughly documenting and explaining design handoffs.

Training developers on how to use the Flame Design System and related tools significantly improved our day-to-day cooperation.

Additionally, frequent team meetings and user story reviews helped identify design flaws early and taught me how to listen actively and respond quickly with mockup updates.

The Opti project strengthened my analytical skills and allowed me to design complex systems that meet both user and business stakeholder expectations.

Designing in line with the Flame Design System gave me hands-on experience in working with a design system and developing new components according to established rules.

Leading usability research that directly influenced product development was also a highly valuable experience.

To sum up, the Opti project gave me comprehensive experience in designing digital products for the financial sector, enhanced my teamwork skills, and improved my ability to conduct UX research, analyze findings, and apply them to design. Thanks to this, I am now better prepared for projects that require flexibility, speed, data analysis, and cross-functional collaboration.